Defining Value in Real Estate: Insights. Strategy. Results.

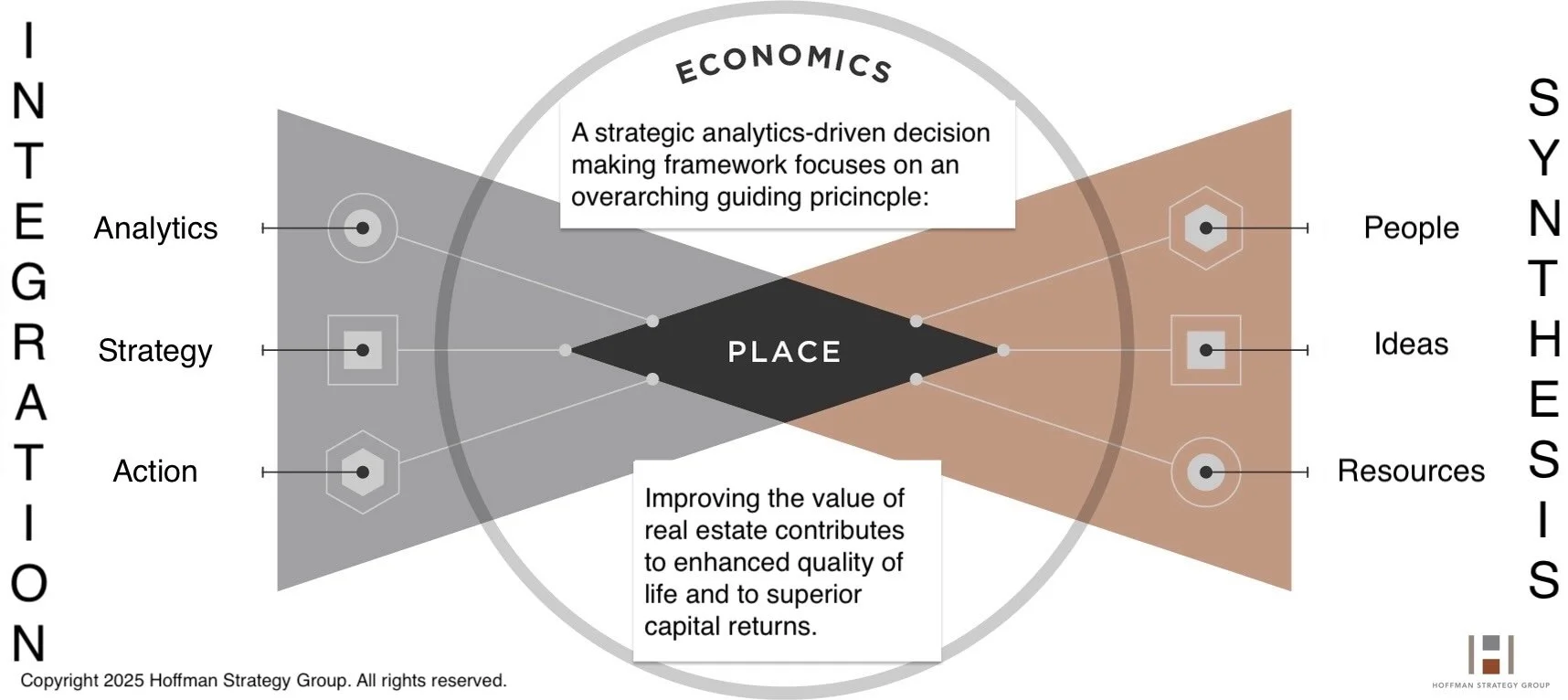

At Hoffman Strategy Group, we help clients define, shape, and grow the value of their real estate projects—whether it’s repositioning a retail center, planning a mixed-use district, or transforming a greenfield into a future city. This post shares our analytics-driven framework and recent examples of how we help developers, landowners, cities, and investors turn market insight into strategy and results.

Making Dollars and Sense of Placemaking Begins with Market Insight

Placemaking isn’t just about creating vibrant spaces — it’s about making strategic decisions that generate long-term value. At Hoffman Strategy Group, we start with market insight to ensure placemaking makes both dollars and sense.

From Insight to Activation: Centennial Yards and the Countdown to FIFA 2026

How retail analytics helped shape tenant strategy at Atlanta’s Centennial Yards ahead of the 2026 FIFA World Cup. This post explores market insights, consumer spending demand, and timing the right mix of uses for activation.

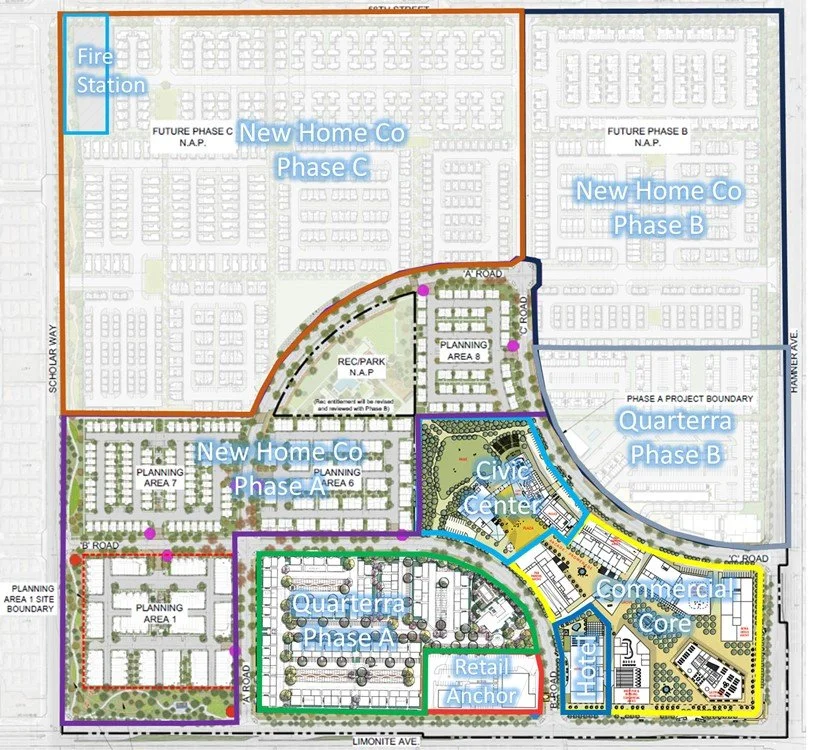

Client Story: Turning City-Owned Land into Real Estate Opportunity in Rancho Cucamonga, CA

A Market Opportunity

Cities frequently have land ripe for development. In Rancho Cucamonga, a 7-acre site near City Hall had been earmarked for "future development." From 2024 to early 2025, we partnered with the City to create a strategy that transformed this vision into a plan based on market insights, consumer demand, and prepared for discussions with developers.

From Plans to Profit: How Economic Impact Analysis Turns Vision Into Value for Land Developers

Clients hire Hoffman Strategy Group to conduct economic impact analysis for their residential and mixed-use real estate projects. The findings are used to successful obtain tax credits and financial incentives from various state and local programs.

Maximizing Market Potential: A Data-Driven Strategy for Thriving Mixed-Use Developments

Hoffman Strategy Group starts each client engagement by defining key challenges, market demand, and development potential. Our analysis evaluates feasibility, revenue potential, and economic impact—ensuring informed, strategic decisions tailored to each client’s goals.

Aliso Viejo's The Commons: A Blueprint for Mixed-Use Success, A Case Study

Hoffman Strategy Group developed an extensive, data-informed plan that guided ValueRock in transforming a 21-acre site into a lively mixed-use destination. By pinpointing market opportunities and outlining practical implementation steps, HSG provided an important decision-making framework for a successful development and sustainable long-term returns on investment.

Transforming Communities: Innovative Approaches to Building Vibrant Spaces

Markets thrive on people-driven dynamics, blending cultural, social, and commercial elements. Hoffman Strategy Group champions community-focused real estate development, creating spaces that foster belonging and vitality. With deep expertise, the group delivers actionable strategies aimed at sustainable success for stakeholders and communities alike.

Unlocking the Power of Place: How Economics of Agglomeration Shapes Neighborhoods and Fuels Real Estate Success

Hoffman Strategy Group envisions a lasting shift towards increased mixed-use real estate development in suburban and urban core areas, departing from the concentric zone model established in the 1920s. This transformation is anticipated to resemble a hub-and-spoke network of "full-service" neighborhoods, aligning with urban design models such as the 20-minute neighborhood or the 15-minute city. While this urban concept is not novel and is already present in various cities and suburban areas in Europe, parts of Asia, and certain U.S. cities (e.g., New York City), the development thesis focuses on incorporating these characteristics into suburban neighborhoods.

Hoffman Strategy Group’s approach is like assembling a puzzle, where every piece represents a unique neighborhood or community. By clustering and diving into the economics of agglomeration, we ensure that our analysis fits together seamlessly to illuminate the paths for urban development. It’s all about finding those hidden opportunities where communities can thrive together.

Unmatched Market Insights Drive $10B+ in Real Estate Success: The Hoffman Strategy Group Approach

The Hoffman Strategy Group (HSG) attributes success to a deep understanding of market dynamics and the ability to translate insights into actionable strategies for real estate acquisition, investment, and development.

This podcast covers how Hoffman Strategy Group's approach of combining deep market insights with a people-centric focus has driven significant success for our clients in the real estate industry. Our ability to adapt to changing trends and execute complex projects with a proven process has resulted in substantial returns for our clients and positive impact on the communities they serve.

Celebrating Client Achievements in 2023: Success in Real Estate, It's a Long Game

It all begins with an idea.

A Holistic Place-Making Framework: 7 Types of Capital for Real Estate Development

It all begins with an idea.