On May 11, 2022, the Eastvale City Council approved an ordinance that allows for a 20-year development agreement by and between the City of Eastvale, CA, and Irvine, CA-based The New Home Company that will result in creation of the new Downtown Eastvale as defined in the Leal Master Plan of 2022.

Many aspects of this project are unique. In brief: Eastvale, CA, part of Riverside County in the Inland Empire region of Southern California, was incorporated in 2010. That is 277 years after the first planned city in the U.S., Savannah, GA, was founded in 1733. For 176 years the land, about 495,000 acres, was used for farming and the dairy industry and was formerly known as the Leal Ranch Property. The City of Eastvale adopted the Leal Master Plan in 2017 to facilitate the development of the 153-acre Leal property. The Leal property boundaries are 58th Street, Hamner Avenue, Limonite Avenue, and Scholar Way. The master plan established the vision for a mixed-used downtown with public space, a civic center (i.e., city hall, library, police station), and a fire station. The New Home Company purchased the 153-acres in 2021 and the City Council approved amendments to the 2017 plan on May 25, 2022 allowing the plan to move forward.

The New Home Company builds beautifully designed homes in “progressive urban villages…surrounded by desirable community amenities, showcasing smart planning and providing easy access to the city’s” they build within. Check out their master plan communities, such as Russell Ranch in Folsom, CA, McKinley Village in East Sacramento, and The Cannery in Davis, CA. The Cannery is California’s first farm-to-table “new home community” that features parks, a recreation center, pools, boutique retail, and an urban farm. The New Home Company’s brand and urban style brought to the Leal property creates a transformative core to the City of Eastvale and the new downtown.

In July 2021, A.J. Jarvis, President of The New Home Company’s Southern California division, Matt Gibson, Corporate Vice President of Land Acquisition, and Peter Carlson, President of Carlson Strategic Land Solutions, brought to Hoffman Strategy Group an interesting problem to solve: Of the 153-acres, what is the optimal amount of land to set aside for market-supportable commercial uses for a future downtown core of Eastvale, CA?

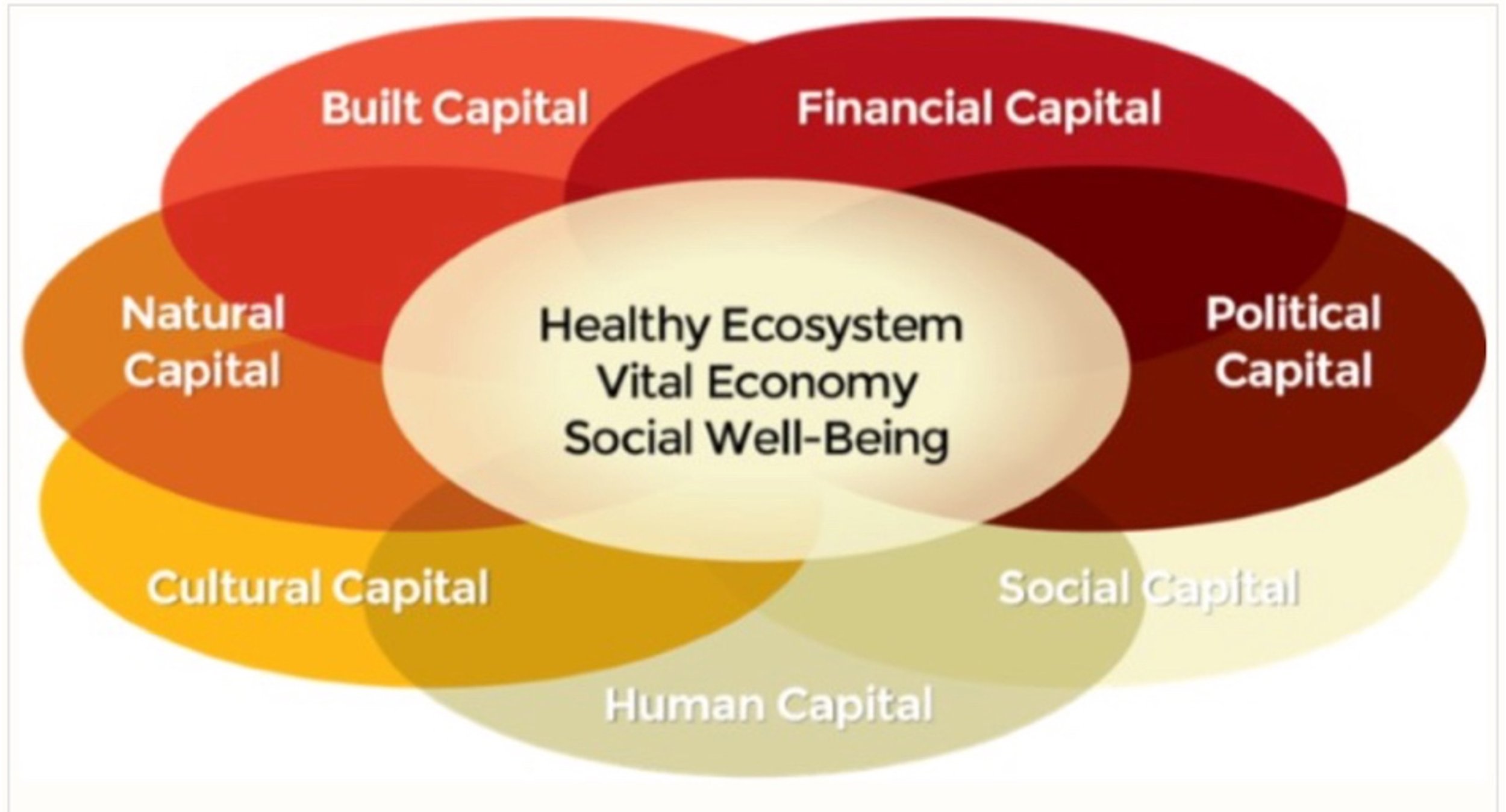

Hoffman Strategy Group’s analytic framework modeled the supply-and-demand building blocks of a mixed-use center: residential, retail, commercial, and civic and public space. Quantitative and qualitative analysis was guided by four pillars in downtown development: create a “magical destination”, maximize energy and vitality, activate mobility, and build a core economic engine. The analysis considered the changing and evolving nature of brick-and-mortar retail, the existing 1.7 million SF of retail GLA in big-box power centers and grocery-anchored centers along the 2-mile corridor of Limonite Avenue and emphasized that significantly more rooftops are necessary to drive demand for retail and commercial activity.

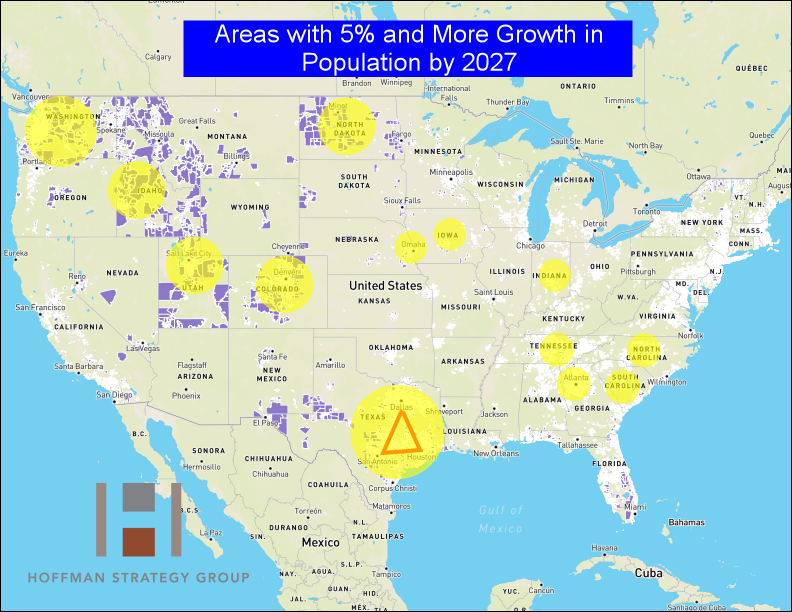

The market analysis started with defining a geographic trade area for “Downtown Eastvale”. An extensive market tour, analysis of geo-spatial movement patterns of consumers using anonymized mobile device data, population and household growth forecasts at the neighborhood level, and identifying new commercial growth areas aided in determining trade area size. For that trade area, the demographic, economic, and psychographic characteristics of household consumers were analyzed for trends in spending potential on housing, retail, groceries, apparel, fast food restaurants, sit-down restaurants, and e-commerce and translating that potential to market-supportable businesses in Downtown Eastvale.

Moreover, Hoffman Strategy Group did a comparative economic analysis of the future Downtown Eastvale to Downtown Claremont, CA, and Downtown Temecula, CA. An element of this analysis focused on the supportable amount of retail, restaurants, and other commercial activity linked to foot traffic volumes generated from core civic uses like city hall, the library, public spaces, etc. in these two mature markets and the quantification of that activity in dollars spent by consumers in downtown businesses and reported business sales.

A development strategy was prepared from the market analysis over the period of July - September 2021. The New Home Company team used this information in their negotiations with the City of Eastvale’s city council and staff on the acreage allocation for Downtown Eastvale. The outcome as codified by the May 11, 2022, city council action on a 5-0 vote: development of a Downtown village core for Eastvale spanning 52 acres and featuring 595,000 SF of commercial space, 660 apartments, a civic center with a city hall, police station, and library, and surrounded by 87 acres for 2,500 single-family homes and townhomes. The 2,500 homes will generate 1,200 students in the Corona-Norco Unified School District. It has been reported that Eastvale has about $100 million to pay for the civic center, grading could begin in fall 2022, and construction could start in 2023.

A.J., Matt, and Peter: Thank you for the opportunity to work on this amazing project with your team.

HSG Services

Hoffman Strategy Group’s principals have over 85 years of collective experience in conducting market and financial feasibility analysis, and economic impact analysis on all types of residential, retail, and commercial real estate projects. We work in markets small-to-large across the U.S. Combining expertise and knowledge from analytics to master planning, development strategy, and execution of that strategy means that we work across multi-disciplinary teams from the C-suite to the project management team in on-site construction trailers.

If you are interested to find out how we can help make your vision become a reality, send an email to Jerry Hoffman, Dan Sheridan, or Jeff Green. We look forward to talking about your real estate development project and finding ways to bring your vision to life.